The U.S. Department of Labor has developed an automated occupational information database, O*NET, that identifies and describes work content, work skills, and training requirements for all jobs across the country in all sectors of the economy. Much of the occupational information contained in this report is derived directly from the O*NET database, and supplemented with information from the Bureau of Labor Statistics, Census Bureau, and Labor Market and Career Information.

| Industry | % of Financial Managers employed | Annual Growth Rate |

|---|---|---|

| Accounting, tax preparation, bookkeeping, and payroll services | 6.4 | 1.53 |

| Insurance carriers | 5.4 | 1.55 |

| Nondepository credit intermediation | 2.9 | 1.93 |

| Computer systems design and related services | 2.3 | 2.85 |

| Management, scientific, and technical consulting services | 2.3 | 3.00 |

| Colleges, universities, and professional schools | 2.3 | 1.93 |

| Agencies, brokerages, and other insurance related activities | 2 | 2.39 |

| 2022 Statewide average hourly wage | $78.37 |

| 2022 National average hourly wage | $79.83 |

| 2020 National employment | 681,700 |

| 2020 Texas employment | 45,170 |

| Texas projected employment by 2030 | 60,204 |

| Texas projected annual employment and Turnover openings through 2030 | 5,228 |

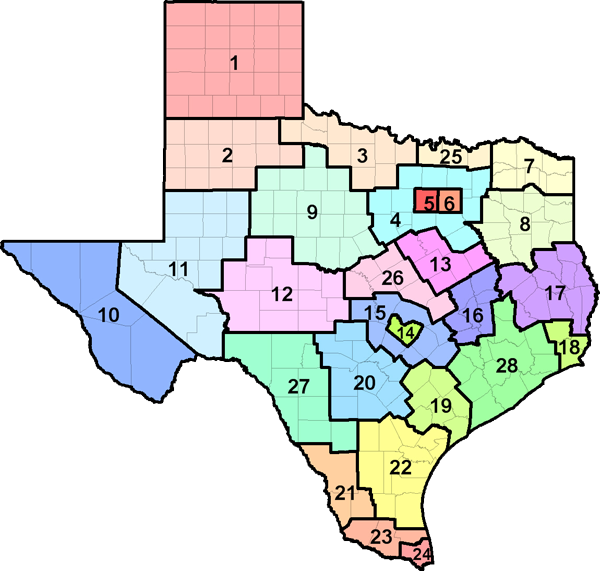

| Region | Employment | Projected Employment 2030 | Projected Annual Openings 2030 |

Annual Growth Rate |

Average Income |

|---|---|---|---|---|---|

| Texas (all regions) | 45,170 | 60,204 | 5,228 | 2.91% | $163,018.00 |

| Top 10 Relevant Knowledge Areas | Relevant Importance Levels |

|---|---|

| Customer and Personal Service Knowledge of principles and processes for providing customer and personal services. This includes customer needs assessment, meeting quality standards for services, and evaluation of customer satisfaction. |

|

| Administration and Management Knowledge of business and management principles involved in strategic planning, resource allocation, human resources modeling, leadership technique, production methods, and coordination of people and resources. |

|

| Economics and Accounting Knowledge of economic and accounting principles and practices, the financial markets, banking, and the analysis and reporting of financial data. |

|

| Mathematics Knowledge of arithmetic, algebra, geometry, calculus, statistics, and their applications. |

|

| Administrative Knowledge of administrative and office procedures and systems such as word processing, managing files and records, stenography and transcription, designing forms, and workplace terminology. |

|

| Law and Government Knowledge of laws, legal codes, court procedures, precedents, government regulations, executive orders, agency rules, and the democratic political process. |

|

| Personnel and Human Resources Knowledge of principles and procedures for personnel recruitment, selection, training, compensation and benefits, labor relations and negotiation, and personnel information systems. |

|

| Sales and Marketing Knowledge of principles and methods for showing, promoting, and selling products or services. This includes marketing strategy and tactics, product demonstration, sales techniques, and sales control systems. |

|

| English Language Knowledge of the structure and content of the English language including the meaning and spelling of words, rules of composition, and grammar. |

|

| Education and Training Knowledge of principles and methods for curriculum and training design, teaching and instruction for individuals and groups, and the measurement of training effects. |

| Top 10 Relevant Skill Areas | Relevant Importance Levels |

|---|---|

| Reading Comprehension Understanding written sentences and paragraphs in work-related documents. |

|

| Active Listening Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times. |

|

| Speaking Talking to others to convey information effectively. |

|

| Critical Thinking Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions, or approaches to problems. |

|

| Writing Communicating effectively in writing as appropriate for the needs of the audience. |

|

| Monitoring Monitoring/Assessing performance of yourself, other individuals, or organizations to make improvements or take corrective action. |

|

| Social Perceptiveness Being aware of others' reactions and understanding why they react as they do. |

|

| Coordination Adjusting actions in relation to others' actions. |

|

| Service Orientation Actively looking for ways to help people. |

|

| Complex Problem Solving Identifying complex problems and reviewing related information to develop and evaluate options and implement solutions. |

| Top 10 Relevant Abilities | Relevant Importance Levels |

|---|---|

| Oral Comprehension The ability to listen to and understand information and ideas presented through spoken words and sentences. |

|

| Written Comprehension The ability to read and understand information and ideas presented in writing. |

|

| Oral Expression The ability to communicate information and ideas in speaking so others will understand. |

|

| Deductive Reasoning The ability to apply general rules to specific problems to produce answers that make sense. |

|

| Speech Clarity The ability to speak clearly so others can understand you. |

|

| Inductive Reasoning The ability to combine pieces of information to form general rules or conclusions (includes finding a relationship among seemingly unrelated events). |

|

| Written Expression The ability to communicate information and ideas in writing so others will understand. |

|

| Problem Sensitivity The ability to tell when something is wrong or is likely to go wrong. It does not involve solving the problem, only recognizing that there is a problem. |

|

| Near Vision The ability to see details at close range (within a few feet of the observer). |

|

| Information Ordering The ability to arrange things or actions in a certain order or pattern according to a specific rule or set of rules (e.g., patterns of numbers, letters, words, pictures, mathematical operations). |