The U.S. Department of Labor has developed an automated occupational information database, O*NET, that identifies and describes work content, work skills, and training requirements for all jobs across the country in all sectors of the economy. Much of the occupational information contained in this report is derived directly from the O*NET database, and supplemented with information from the Bureau of Labor Statistics, Census Bureau, and Labor Market and Career Information.

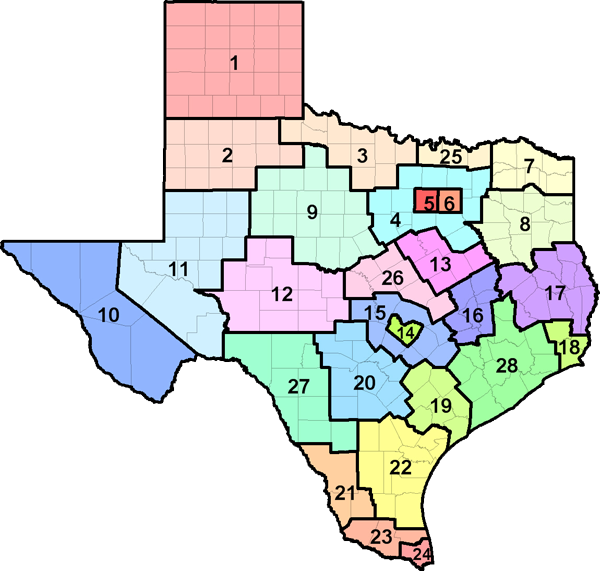

| Region | Employment | Projected Employment 2030 | Projected Annual Openings 2030 |

Annual Growth Rate |

Average Income |

|---|---|---|---|---|---|

| (all regions) |

|

|

|

|

|