The U.S. Department of Labor has developed an automated occupational information database, O*NET, that identifies and describes work content, work skills, and training requirements for all jobs across the country in all sectors of the economy. Much of the occupational information contained in this report is derived directly from the O*NET database, and supplemented with information from the Bureau of Labor Statistics, Census Bureau, and Labor Market and Career Information.

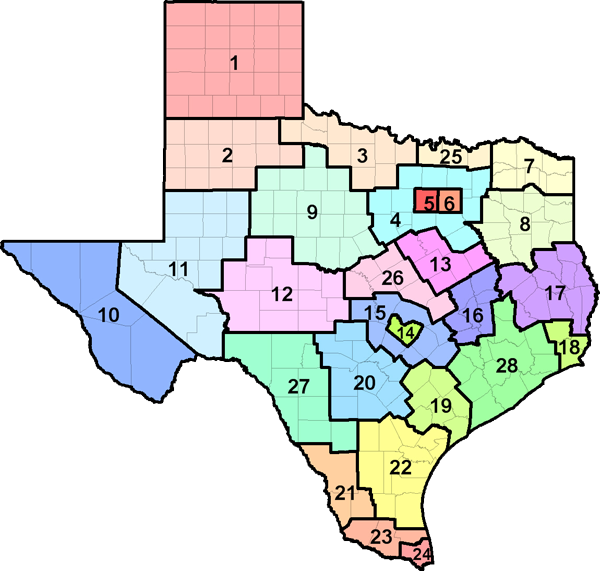

| Region | Employment | Projected Employment 2032 | Projected Annual Openings 2032 |

Annual Growth Rate |

Average Income |

|---|---|---|---|---|---|

| Texas (all regions) |

|

|

|

|

|

| Top 10 Relevant Knowledge Areas | Relevant Importance Levels |

|---|---|

| English Language Knowledge of the structure and content of the English language including the meaning and spelling of words, rules of composition, and grammar. |

|

| Customer and Personal Service Knowledge of principles and processes for providing customer and personal services. This includes customer needs assessment, meeting quality standards for services, and evaluation of customer satisfaction. |

|

| Computers and Electronics Knowledge of circuit boards, processors, chips, electronic equipment, and computer hardware and software, including applications and programming. |

|

| Mathematics Knowledge of arithmetic, algebra, geometry, calculus, statistics, and their applications. |

|

| Law and Government Knowledge of laws, legal codes, court procedures, precedents, government regulations, executive orders, agency rules, and the democratic political process. |

|

| Administrative Knowledge of administrative and office procedures and systems such as word processing, managing files and records, stenography and transcription, designing forms, and workplace terminology. |

|

| Building and Construction Knowledge of materials, methods, and the tools involved in the construction or repair of houses, buildings, or other structures such as highways and roads. |

|

| Administration and Management Knowledge of business and management principles involved in strategic planning, resource allocation, human resources modeling, leadership technique, production methods, and coordination of people and resources. |

|

| Economics and Accounting Knowledge of economic and accounting principles and practices, the financial markets, banking, and the analysis and reporting of financial data. |

|

| Geography Knowledge of principles and methods for describing the features of land, sea, and air masses, including their physical characteristics, locations, interrelationships, and distribution of plant, animal, and human life. |

| Top 10 Relevant Skill Areas | Relevant Importance Levels |

|---|---|

| Reading Comprehension Understanding written sentences and paragraphs in work-related documents. |

|

| Active Listening Giving full attention to what other people are saying, taking time to understand the points being made, asking questions as appropriate, and not interrupting at inappropriate times. |

|

| Speaking Talking to others to convey information effectively. |

|

| Critical Thinking Using logic and reasoning to identify the strengths and weaknesses of alternative solutions, conclusions, or approaches to problems. |

|

| Complex Problem Solving Identifying complex problems and reviewing related information to develop and evaluate options and implement solutions. |

|

| Writing Communicating effectively in writing as appropriate for the needs of the audience. |

|

| Judgment and Decision Making Considering the relative costs and benefits of potential actions to choose the most appropriate one. |

|

| Social Perceptiveness Being aware of others' reactions and understanding why they react as they do. |

|

| Coordination Adjusting actions in relation to others' actions. |

|

| Active Learning Understanding the implications of new information for both current and future problem-solving and decision-making. |

| Top 10 Relevant Abilities | Relevant Importance Levels |

|---|---|

| Written Comprehension The ability to read and understand information and ideas presented in writing. |

|

| Oral Expression The ability to communicate information and ideas in speaking so others will understand. |

|

| Deductive Reasoning The ability to apply general rules to specific problems to produce answers that make sense. |

|

| Inductive Reasoning The ability to combine pieces of information to form general rules or conclusions (includes finding a relationship among seemingly unrelated events). |

|

| Oral Comprehension The ability to listen to and understand information and ideas presented through spoken words and sentences. |

|

| Near Vision The ability to see details at close range (within a few feet of the observer). |

|

| Speech Recognition The ability to identify and understand the speech of another person. |

|

| Speech Clarity The ability to speak clearly so others can understand you. |

|

| Information Ordering The ability to arrange things or actions in a certain order or pattern according to a specific rule or set of rules (e.g., patterns of numbers, letters, words, pictures, mathematical operations). |

|

| Written Expression The ability to communicate information and ideas in writing so others will understand. |